No credit check apartments for rent near me: Finding a place to live can be stressful, especially for those with less-than-perfect credit histories. This search term reflects a growing need among renters seeking housing options without the traditional credit score barrier. This article explores the realities of this market, examining the advantages, disadvantages, and considerations for prospective tenants.

The demand for no credit check apartments stems from various factors, including recent financial setbacks, limited credit history, or simply a desire to avoid the stringent requirements of traditional rental applications. Understanding the nuances of this market, including location-specific factors, apartment features, application processes, and potential risks, is crucial for renters seeking this type of accommodation. This guide aims to provide a comprehensive overview of this niche rental sector.

Understanding the Search for “No Credit Check Apartments Near Me”: No Credit Check Apartments For Rent Near Me

The search term “no credit check apartments for rent near me” reveals a specific need among renters facing credit challenges. This phrase signifies a crucial stage in their housing search, reflecting a pressing need for immediate accommodation and highlighting potential financial constraints.

Motivations Behind the Search, No credit check apartments for rent near me

Renters utilize this search term primarily due to poor credit history or a lack of established credit. This often stems from various factors, including past financial difficulties, limited credit history, or recent life events impacting credit scores. The urgency behind the search indicates a need for housing quickly, possibly due to eviction, job relocation, or other time-sensitive circumstances.

Types of Renters Using This Search Term

This search term attracts a diverse range of renters. They include young adults entering the rental market for the first time, individuals experiencing temporary financial setbacks, those rebuilding their credit, and immigrants or newcomers to the area with limited credit history in the country. Each group possesses unique challenges and priorities when seeking housing.

Key Concerns and Priorities

The primary concerns for these renters center around affordability and finding a safe, secure place to live. Finding a landlord willing to overlook poor credit is paramount. They also prioritize proximity to work, schools, or public transportation, reflecting practical considerations and budget constraints. Concerns about hidden fees or predatory rental practices are also heightened.

Comparison of Renters with and Without Good Credit Scores

Renters with good credit scores enjoy a wider selection of apartments and often negotiate better lease terms. They have more leverage in choosing desirable features and locations. Conversely, renters with poor credit face limited options, potentially higher rental costs, and stricter lease terms. Their choices are often dictated by the availability of “no credit check” options, which may compromise their preferences.

Location-Based Search Refinement

The location of “no credit check” apartments significantly impacts a renter’s choices. Factors such as affordability, commute times, and neighborhood safety play crucial roles in decision-making.

Factors Influencing Location Choices

Renters with poor credit often prioritize affordability above all else. This frequently leads them to consider locations further from city centers or in areas with lower average rental costs. Proximity to public transport becomes vital to offset potential higher transportation costs. Safety concerns are paramount, influencing the selection of neighborhoods perceived as safe and well-maintained.

Categorizing Locations Based on Apartment Availability and Rental Costs

Locations can be categorized into tiers based on rental cost and availability of “no credit check” apartments. Tier 1 might represent high-demand areas with expensive rentals and limited “no credit check” options. Tier 2 could be more affordable areas with moderate availability, and Tier 3 could consist of less desirable but more affordable locations with higher availability of such apartments.

This system helps renters assess their options realistically.

Impact of Proximity to Work, Schools, or Public Transport

Proximity to employment, schools, and public transportation directly impacts a renter’s budget and daily life. Choosing a location closer to work minimizes commute costs and time, while proximity to schools is essential for families. Reliable public transportation is crucial for renters without personal vehicles.

Role of Neighborhood Safety and Amenities

Neighborhood safety and available amenities heavily influence location decisions. Renters seek areas with low crime rates, well-maintained properties, and access to essential services like grocery stores and healthcare facilities. The presence of parks, community centers, and other amenities enhances the overall quality of life.

Apartment Features and Amenities

Renters with poor credit often face trade-offs between desired features and affordability. Understanding these trade-offs is crucial for making informed decisions.

Comparison of Apartment Features

| Features | Average Cost Impact | Renter Desirability |

|---|---|---|

| In-unit laundry | Medium | High |

| Central air conditioning | Medium | High |

| Updated kitchen appliances | High | High |

| Pet-friendly policy | Low to Medium | Medium to High (depending on pet owner) |

| Off-street parking | Low to Medium | Medium |

| Balcony or patio | Low | Medium |

Essential Amenities and Their Relative Importance

Essential amenities for renters with poor credit often include safe and secure buildings, well-maintained units, and reliable utilities. Proximity to public transportation and essential services like grocery stores and pharmacies are also highly prioritized.

Trade-offs Between Desired Features and Affordability

Renters often prioritize essential amenities over luxury features to stay within their budget. They may opt for smaller units or older buildings with fewer amenities to afford a location that meets their other needs. This necessitates careful evaluation of needs versus wants.

Impact of Pet Policies and Parking Availability

Pet-friendly policies and parking availability can significantly impact the search. Renters with pets often face higher costs or limited options, while parking can be a crucial factor for those without reliable public transport. These considerations are often factored into the overall budget.

Rental Process and Application

The application process for “no credit check” apartments differs from traditional rentals. Understanding these differences is vital for a smooth process.

Steps Involved in Applying

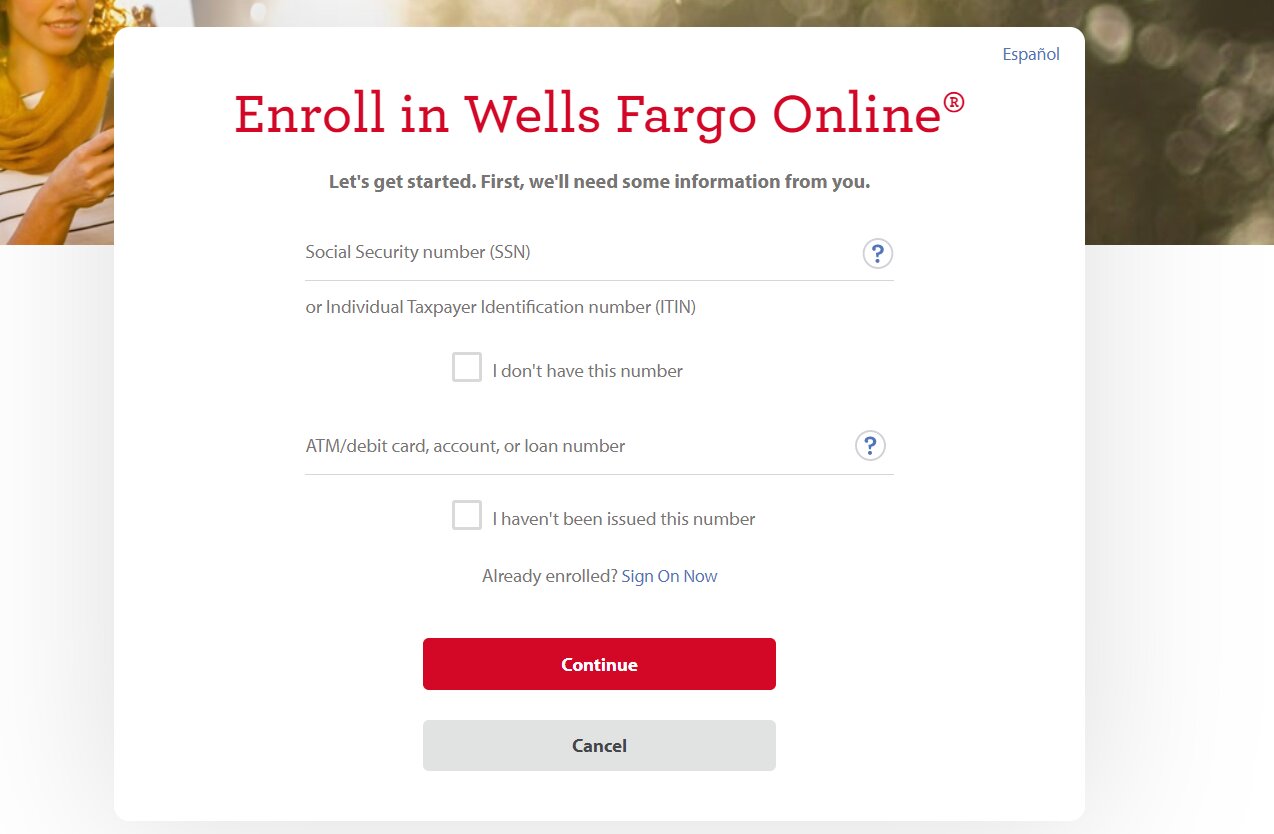

The process typically involves completing a rental application, providing proof of income and employment, and undergoing a background check. Landlords may request references or verify employment history. Some landlords may also utilize alternative credit verification methods.

Alternative Forms of Credit Verification

Landlords might use bank statements, pay stubs, or rental history reports to assess financial responsibility. They may also consider guarantors or co-signers to mitigate risk. These alternative methods provide insights into a renter’s financial stability in the absence of a traditional credit score.

Potential Upfront Costs and Fees

Renters should anticipate first month’s rent, last month’s rent (in some cases), a security deposit, and potentially application fees. These costs can be significant, so budgeting is crucial. Transparency about all fees is vital before signing a lease.

Flowchart of the Rental Application Process

A flowchart would visually represent the steps: Application Submission → Background Check → Income Verification → Alternative Credit Assessment (if applicable) → Lease Agreement → Move-in.

Notice craigslist pets pittsburgh for recommendations and other broad suggestions.

Risks and Considerations for Renters

Renting “no credit check” apartments carries inherent risks. Renters need to be vigilant to protect themselves from scams and ensure a safe and secure rental experience.

Potential Risks Associated with No Credit Check Apartments

Risks include encountering unscrupulous landlords, poorly maintained properties, and higher likelihood of hidden fees or unexpected costs. The lack of credit checks may attract tenants with a history of non-payment, potentially impacting the overall living environment.

Importance of Thoroughly Researching Landlords and Properties

Renters should carefully research the landlord’s reputation, review online reviews, and verify the property’s condition before signing a lease. Checking local court records for past legal issues is advisable. Due diligence minimizes risks.

Strategies for Protecting Renters from Scams

Renters should be wary of unusually low rental rates, requests for upfront payments via wire transfer, and landlords who avoid in-person meetings. Verifying the landlord’s identity and property ownership is crucial. Never rush into a decision.

Questions Renters Should Ask Potential Landlords

- What is included in the rent?

- What is the condition of the property?

- What are the rules and regulations?

- What is the process for resolving maintenance issues?

- What is the landlord’s policy on late rent payments?

Alternatives to No Credit Check Apartments

Renters with poor credit have alternative options to consider, each with its advantages and disadvantages.

Comparison with Other Rental Options

Options include working with a co-signer, providing a larger security deposit, or focusing on improving credit scores. Each option involves different trade-offs and requires careful consideration of individual circumstances.

Advantages and Disadvantages of Each Alternative

Co-signers offer credit risk mitigation but require a trusted individual with good credit. Larger security deposits reduce landlord risk but represent a significant upfront cost. Credit score improvement takes time but opens up a wider range of rental options in the long term.

Programs and Services Assisting Renters with Building Credit

Credit counseling services and secured credit cards can help rebuild credit. Consistent on-time rent payments, even without a formal credit report, can indirectly contribute to building credit history over time. Many resources are available.

How Improving Credit Scores Unlocks Better Rental Opportunities

Improved credit scores significantly expand rental options. Renters gain access to a wider variety of apartments, potentially better lease terms, and more negotiating power. This translates to better living conditions and potentially lower costs in the long run.

Visual Representation of Data

Distribution of “No Credit Check” Apartments

A histogram could visually represent the distribution of “no credit check” apartments across different price ranges and locations. The x-axis would represent price brackets (e.g., $500-$750, $750-$1000, etc.), and the y-axis would represent the number of apartments available in each price bracket for different geographic areas (e.g., city center, suburbs, etc.). This visualization would highlight the relationship between price, location, and apartment availability.

Comparison of Average Rental Costs

A bar chart would effectively compare the average rental costs of “no credit check” apartments with those requiring credit checks. The x-axis would represent the two categories (“No Credit Check” and “Credit Check Required”), and the y-axis would represent the average monthly rent. Data could be collected from rental listings websites to calculate average costs for different apartment types and locations.

This would illustrate the potential cost premium associated with “no credit check” rentals.

Securing housing without a stellar credit score is possible, but it requires careful planning and due diligence. Understanding the unique aspects of the “no credit check” apartment market empowers renters to make informed decisions and navigate the rental process effectively. While these options offer accessibility, renters should prioritize thorough research and cautious engagement to avoid potential pitfalls. Ultimately, a balanced approach that weighs convenience against potential risks will lead to a successful housing outcome.